extended child tax credit portal

4 1 Amount increase 0 500 1000 1500 2000 2500 3000 3500 Previous Child Tax Credit. Through this portal you can sign up as a non-filer or update your information if you do pay taxes and simply need to change information such as direct deposit or income.

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

The 500 nonrefundable Credit for Other Dependents amount has not changed.

. Once you reach the homepage you will. If you are eligible for the Child Tax Credit but did not get any advance payments in 2021 you can still get a lump-sum payment by claiming the Child Tax Credit benefit when you file. The bank account update feature was added to the Child Tax Credit Update Portal available only on IRSgov.

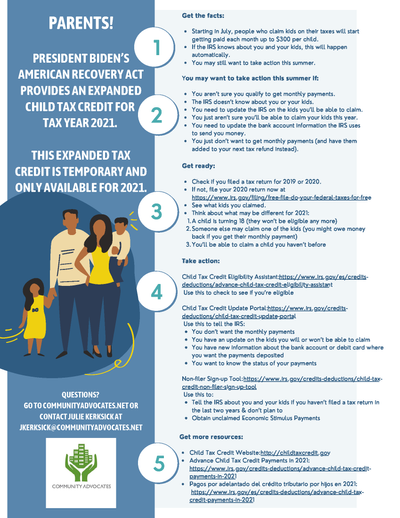

The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for qualifying children 6-17. 2021 Tax Filing Information Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you. But others are still pushing for.

WASHINGTON The Internal Revenue Service today upgraded a key online tool to enable families to quickly and easily update their bank account information so they can receive their monthly Child Tax Credit payment. 3600 for children ages 5 and under at the end of 2021. President Biden has proposed extending the enhanced Child Tax Credit including monthly payments for at least 2022.

CLICK HERE to go to the IRS Child Credit Portal for more information. The IRS has set up an online CTC Update Portal for people to register for the child tax credit on their own. Previously the credit was 2000 per child under 17 and will revert back to that.

Half of the money will come as six monthly payments and. See below for more information. Your advance Child Tax Credit payments were based on the children you claimed for the Child Tax Credit on your 2020 tax return or 2019 tax return if your 2020 tax return had not been processed as of the payment determination date for any of your monthly advance Child Tax Credit payments.

It also made the. If the enhanced child tax credit payments were to be extended -- and be fully refundable -- it could drop child poverty by 40 according to Maag. 3000 for children ages 6 through 17 at the end of 2021.

The advance Child Tax Credit or CTC payments began in July 2021 and end by 2022. The expansion imposed as part of the. That will send families up to 250 a month for every child between 6 and 17 years old and up to 300 a month for kids under 6.

3600 17-year-olds eligible for the first time. The credit will be fully refundable. It also provided monthly payments from July of 2021 to December of 2021.

The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child. The credit was made fully refundable. Congress fails to renew the advance Child Tax Credit.

You can access the CTC Update Portal here. A recent study published by the Urban Institute shows that if the child tax credit is extended beyond 2021 it could substantially reduce child poverty in the vast majority of. Specifically the Child Tax Credit was revised in the following ways for 2021.

IRS Child Tax Credit Portal and Non-filers. The IRS will pay 3600 per child to parents of young children up to age five. The Child Tax Credit Update Portal is no longer available.

The child tax credit is up from 2000 to 3600 for kids under six and 3000 for children six to 17 years old. Previous Child Tax Credit. The Child Tax Credit was expanded under the Key Ways American Rescue Plan in FOUR key ways.

Credit is now fully refundable. The enhanced child tax. The enhanced child tax credit payments are only set to last through 2021 but President Biden has suggested that this may be extended through as long as 2025 as part of the American Families Plan.

The extra money could help offset the effects of. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. Finally if the qualifying children you listed in a Non-Filer Tool in 2020 or 2021 are the same qualifying children you had in 2021 you probably only received.

Here is some important information to understand about this years Child Tax Credit. 3000 For children under 6. 2000 For children 6 through 17.

Credits increase from 2000 to 3600 per child under 6 and 3000 for children older than 6. The expanded child tax credit includes up to 3600 per child under age 6 and 3000 per child ages 6 through 17. Prior to this years expansion families received a credit of up to 2000 per child under age 17.

The Child Tax Credit provides money to support American families. Treasury sends the first monthly round of CTC advance payments to families of more than 60 million children. Those who miss the deadline can still claim the credit of up to 3600 per child if they file a 2021 tax return next year.

Most recently lawmakers proposed extending the child tax credit to just one year in an effort to trim the cost of President Joe Bidens 35 trillion plan. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for other qualifying children under age 18. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to.

The credit amount was increased for 2021. IR-2021-143 June 30 2021.

What Families Need To Know About The Ctc In 2022 Clasp

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How The New Expanded Federal Child Tax Credit Will Work

Irs Child Tax Credit Payments Start July 15

Five Facts About The New Advance Child Tax Credit

The Child Tax Credit Toolkit The White House

Child Tax Credit Schedule 8812 H R Block

December Child Tax Credit What To Do If It Doesn T Show Up Abc10 Com

Child Tax Credit What We Do Community Advocates

The December Child Tax Credit Payment May Be The Last

White House Unveils Updated Child Tax Credit Portal For Eligible Families

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

The Child Tax Credit Toolkit The White House

The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back